Has COVID catalysed the digital transformation of the remittance industry?

COVID-19 has fundamentally changed a lot this year. In the case of the money transfer industry, the immediate impact has not been a positive one. The World Bank has predicted that global remittances are set to decline by 20% as a direct result of the pandemic. Something needs to be done and it’s the young and nimble money transfer operators (MTOs) that are best equipped to create a new digital path in a world where physical contact is restricted.

The evidence of digital transformation

Digital transformation has been slowly changing the remittance sector for decades now and COVID has hastened that transformation. The fact is, where digital was once an option it’s now a necessity and that has completely changed the game for all banking sectors.

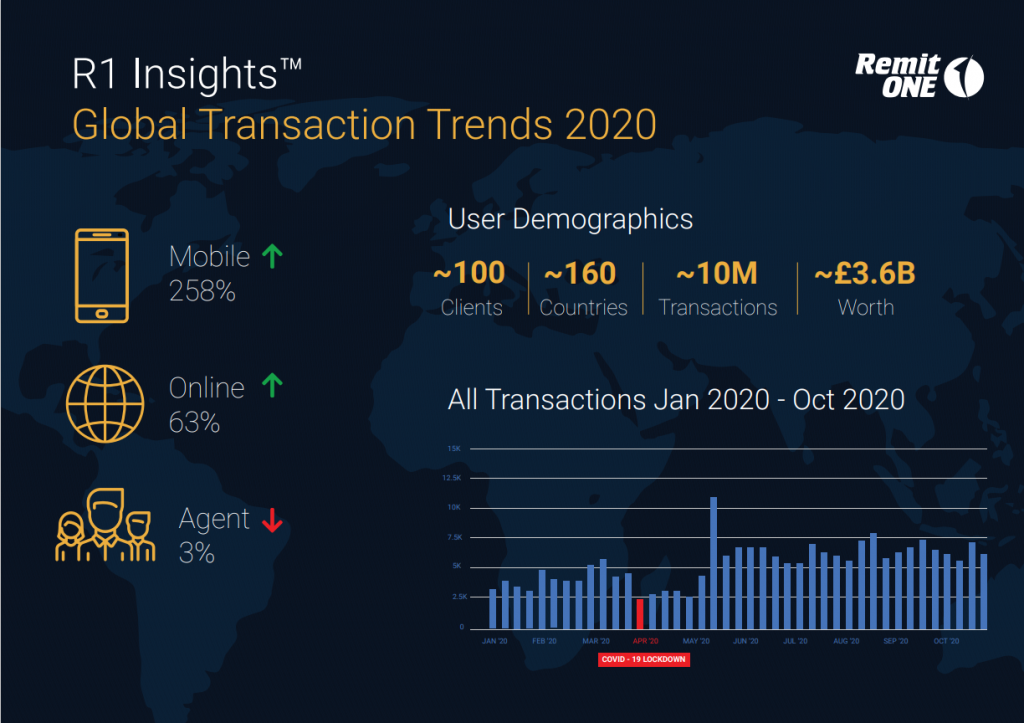

According to recent RemitONE transaction data trends, there has been a major acceleration of digital channel use during the pandemic. The use of physical agents, meanwhile, is down, which might seem insignificant but points to a drastic overall shift in consumer habit.

Throughout history, it’s the sectors that have been able to adapt to the times that have weathered the storms and retained their relevance. With the recession caused by COVID-19 taking a toll on the ability to send money home and remittance flows projected to decline even further by 14% in 2021, an easier, cheaper remittance solution has never been more vital.

Digital money transfer

Studies have proven that remittance not only helps to alleviate poverty in developing countries but can also lead to an increase in domestic spending. If there’s one thing we need right now it’s for people to be spending more. Digital-first MTOs are the ones ready to offer the most robust and accessible easy-to-use remittance services with fair and reliable exchange rates.

Of course, this is not a change that can happen overnight. Historically speaking, migrant communities would rely on physical money transfer services and these services have, as a result, become pillars of the community. Indeed, it’s estimated that the recipients of many international remittances are unbanked, which might go some way towards explaining why 90% of remittances currently begin and end with cash.

Does this mean it’s up to remittance operators to prove their worth and make themselves more accessible? Because digital operators that use the latest remittance software are not faster and only more affordable due to the obvious lack of overheads but have been proven to be better at evaluating customer experience and security.

Digital acceleration beyond the pandemic

It’s no exaggeration to suggest that COVID-19 changed the world overnight, but the impact on the migrant community has been under-reported. For months now, foreign travel has been almost impossible, which means migrant families have been unable to visit their families. What’s more, the pandemic has amplified the pressures migrants face in striking a balance between supporting themselves and supporting their families back home. For these families, digitally native money transfer operators will play a crucial role in redefining remittance and money transfer for a post-COVID world.

There are several benefits of digital transformation for the remittance sector for both legacy and upstart operators. Through the use of money transfer software on desktop computers and via smartphone apps, it’s never been easier and faster for customers to keep a reliable track of their remittance journey. The pandemic might have offered an opportunity for operators to use this software to foster trust and build new customer bases that keep communities connected and able to hold each other up.

This is proven by the growth of M-Pesa as the predominant payment method in Kenya. This is a digital solution that manifested because a traditional banking ecosystem was simply not accessible for a majority of Kenyans. That digital alternative quickly became the preferred option when users realised how powerful, easy, and convenient it was. Ultimately, it’s a safer, faster, and easier service that should help shoulder some of the stress that migrant families currently find themselves under.

Conclusion

Consumer preference has been shifting away from cash for years now and with many cash-based remittance solutions forced to close due to COVID-19, the future is definitely in digital. What money transfer operators and other fintech organisations need to understand is that this represents an incredible opportunity for them to prove their worth.

Borders might be closed but migrant workers still depend on remittance and if they’re going to make that switch from their old inflexible and outdated conventional means to more accessible solutions, they might need a bit of a gentle push.

To discuss your online offering with our team of experts please contact marketing@remitone.com

R1 Webinar: How money service businesses can maintain growth during a global pandemic

15:00 GMT, Wednesday 25 November 2020

Access the event today at 15:00 GMT here – https://zoom.us/j/97768332874

Join our next webinar where we will review recent challenges Money Service Businesses are facing, impacted by the global pandemic.

We will reveal how RemitONE clients have adapted to these new challenges and in doing so have maintained business growth and ensured compliance:

- Maintaining business growth – Challenging for any business impacted by the global pandemic and with the World Bank predicting global remittances will decline by 20% in 2020, it is critical that we all take action to keep money transfers flowing.

- We will share how JMMB have maintained business growth. How they have increased transaction volumes, expanded operations and scaled their business.

- Ensure compliance– Regulators have become even more stringent and we are seeing growing pressure by central banks to track inbound and outbound transactions.

- We will explain how Bank Asia delivers a robust and compliant platform. How they enforce KYC and AML procedures with ease, allowing them reduce costs and focus on other business goals.

- Licensing – A three-fold increase in new entrants to the market, judging from the number of MSB applications being submitted to regulators in different regions.

- We will reveal how Nation Transfer successfully obtained an SPI licence so they could facilitate cross border payments from the UK via digital channels.

Join our next webinar where we will discuss how we are working with clients to overcome these key challenges and take advantage of the opportunities that lie ahead!

We look forward to seeing you there.

15:00 GMT, Wednesday 25 November 2020.

Access the event today at 15:00 GMT here – https://zoom.us/j/97768332874

About RemitONE

RemitONE is a technology and business services firm that breathes innovation and excellence into the money transfer world for all types and sizes of organisations including banks, money transfer operators, micro-finance institutions, telecom firms and start-ups. Our technology allows you to manage your entire money transfer business and connect with our extensive client and partner network worldwide. Our consulting services have an impressive success rate for money service business license applications and alternative bank account solutions.

Follow us on Twitter (@RemitONE) and LinkedIn (RemitONE) for the latest industry updates.

RemitONE Proud Platinum Sponsor of IMTC World 2020

We’re thrilled to be sponsoring and participating at IMTC World, 16-19 November 2020. The conference is the largest international money transfer, cross border payments and fintech event globally. This year’s online event is packed with sessions featuring the industry’s most prominent leaders, executives and pioneers.

RemitONE CMO, Aamer Abedi will be joined by, Nadeem Qureshi, CTO, USI Money; Richard Spink, Senior Business Development Manager, GBG ; Sidharth Gautam, Head of Sales, AZA and David Lambert, Commercial Director, Transact 365 for what promises to be one of the most informative panel discussions: A New Normal: Getting digital ready for post-pandemic recovery.

Participants will learn how to leverage digital technology to achieve business continuity during the pandemic, transform customer experience, ensure compliance and obtain a remittance bank account. Join the discussion in the Tropical Room at 13:00 GMT on Tuesday 17 November to take part.

Anwar H Saleem, CEO of RemitONE shared “We’re excited to meet with those looking for an opportunity to add value to their business and look forward to re-connecting with current partners. IMTC World is crafted around critical business discussions led by industry experts. We’re proud to participate in this top-tier event.”

Visit our Booth #P2 at the IMTC World, online, from 16-19 November 2020.

Join the event here – https://web.cvent.com/event/1e534a43-8f77-4b6f-af97-a69ccc023f4d/

About RemitONE

RemitONE is a technology and business services firm that breathes innovation and excellence into the money transfer world for all types and sizes of organisations including banks, money transfer operators, micro-finance institutions, telecom firms and start-ups. Our technology allows you to manage your entire money transfer business and connect with our extensive client and partner network worldwide. Our consulting services have an impressive success rate for money service business license applications and alternative bank account solutions.

Follow us on Twitter (@RemitONE) and LinkedIn (RemitONE) for the latest industry updates.