R1 Webinar: The Future of Remittances

Video: Remittances from the Gulf – The Impact of Covid-19 and Trends for 2021

During IMTC World 2020, RemitONE’s CMO, Aamer Abedi, moderated an engaging panel discussion on Remittances from the Gulf – The Impact of COVID and trends for 2021. During the panel he asked industry experts from the UAE, Saudi Arabia and Pakistan; how the market has been impacted; has COVID accelerated a digital transformation; and what’s the landscape for competition in your region.

Watch the full discussion here or read the highlights below:

How has your region been affected?

Osama Al Rahma, Advisor at Al Fardan Exchange and Vice Chairman of the Foreign Exchange & Remittance Group in UAE, commented that in the UAE there has been an unprecedented lockdown and control of the mobility of people has been restricted. He adds that it is unique that the workforce in the UAE is 90% ex-pats from over 200 nationalities and all are under the wage protection system. In terms of remittances, the service continued during the lockdown, the government recognised receiving countries are in severe need for the service and it’s thanks to authorities that permission could continue.

Khalid Al Zain, Head of Business Development at Bank Albilad in Saudi Arabia, commented that the Saudi Arabian Government has been investing in the private sector to keep their staff employed. He adds, there have been measures from the regulators including social distancing. Khalid notices that there is an impact but it’s not too much. Due to the support from the government and measures taken, such as social distancing, hygiene and increased security. He adds that despite COVID the number of employees is increasing and the workforce is in a good shape in Saudi Arabia.

How has the market been impacted?

Faisal Rashid is Head of Financial Institutions, International Banking & Home Remittance Business at Bank Alfalah in Pakistan, he explains that as Pakistan is predominantly a receiving country you would expect the country to be impacted significantly by COVID. However, he has found that from the GCC, where Pakistan receives its bulk of transactions, remittances have grown by 25%. He adds this is driven primarily by a 66% increase from Saudi Arabia and a 17% increase from the UAE. He believes this increase is due to the strength of partners in those regions moving from agent to digital channels. He also mentions that the receiving side in Pakistan has struggled to convert to digital pay-out due to the lack of infrastructure and the digital ecosystem.

Osama explains that in the UAE there have been declines in remittances, Egypt by 8%, India by 17% and the Philippines by 24%. However, they have seen growth in Pakistan by 11.5%. He believes this increase is due to transactions going through unofficial channels now moving to official channels. It could be argued that this is one of the positives coming out of the pandemic.

Khalid adds in Saudi Arabia they saw a decline in remittances during the initial phase of the pandemic, however, this has since changed and overall, they have witnessed growth in remittance by 8%. He also explains that customers are moving to digital channels rather than using traditional methods.

Has COVID accelerated a digital transformation?

Faisal comments that Pakistan is a young population who understands modern digital communication tools, however, only one-third of the total population is using smartphones causing a barrier to moving online. He adds that basic smartphones are now becoming available which is what Pakistan needs to create an ecosystem to make it easier to move money around. The graduation of moving to digital channels has started, all banks are working on their digital offering and we will see a large shift in the coming years with COVID hastening the transformation.

Osama agrees that COVID has accelerated the digital transformation of remittances in the UAE, but mentions that the Government of the UAE created a strategic initiative for digital transformation before COVID, which included strategy around infrastructure, policies, regulation and cybersecurity. This initiative includes the ‘UAE Pass’ which provides UAE citizens with full digital identity. These initiatives coupled with 80% of the population using smartphones, have provided the UAE with a seamless transition to moving online. Osama notices that the technology, infrastructure, and cybersecurity are all available in the country, which enhances the customers’ experience on the digital level.

Khalid has found that the migration of customers to digital is going excellently in Saudi Arabia and he notices a spike in migration of customers to digital. He explains that all citizens in Saudi Arabia are required to provide a fingerprint for their ID card and data has been stored in the mainframe. The private and government sectors can liberate from this data which has allowed Khalid and his team to introduce E-KYC seamlessly. Khalid notices that lots of customers are moving from traditional methods to digital.

What’s the landscape for competition in your region?

Khaled comments that Saudi Arabia wants to be a cashless society by 2030. He adds there are lots of strategies and initiatives in place, organised by the Saudi Arabian regulators, to open the market and invite many players to come. He believes that by increasing competition in the market, services will improve and it’s not just about one bank, there are lots of players in the market.

Similarly, Osama explains, in the UAE we have regulatory bodies such as Abu Dhabi Global Markets (ADGM) they have their regulations and initiatives for start-ups to support, facilitate and encourage fintech companies. The UAE also have Hub 71, which is a body to support start-ups, that have a payment lab to support innovation and testing. He adds, In Dubai, we have the Fintech Hive and the Dubai Economic Develop Department, where Pay Engage is the latest initiative. He explains that initiatives are being set up to allow for more innovation and similarly to Saudi Arabia, to move towards a cashless society. He concludes, there are strategies and clear milestones in place, with all stakeholders involved including federal and local government. There is a shift and it’s happening very quickly which is encouraging many companies to move their businesses to the UAE because they can benefit from the infrastructure.

Conclusion – COVID-19: An agent of change

The pervasive atmosphere in the sector appears to be one of defiant optimism in the face of some pretty sobering stats. The vast majority of the challenges posed by the pandemic, however, are either short-term by nature or have, in some of the cases outlined above, already been overcome.

Remittance will always represent a lifeline for developing countries and as technology adoption continues to penetrate every part of the globe, digital transformation is something that can’t be ignored any longer. Nobody is going to remember coronavirus as a ‘good thing’ but it could at least be recognised as an agent of change and change is often necessary, even if it feels a little intimidating at the time.

For more information or to speak to one of our experts please email marketing@remitone.com

Has COVID catalysed the digital transformation of the remittance industry?

COVID-19 has fundamentally changed a lot this year. In the case of the money transfer industry, the immediate impact has not been a positive one. The World Bank has predicted that global remittances are set to decline by 20% as a direct result of the pandemic. Something needs to be done and it’s the young and nimble money transfer operators (MTOs) that are best equipped to create a new digital path in a world where physical contact is restricted.

The evidence of digital transformation

Digital transformation has been slowly changing the remittance sector for decades now and COVID has hastened that transformation. The fact is, where digital was once an option it’s now a necessity and that has completely changed the game for all banking sectors.

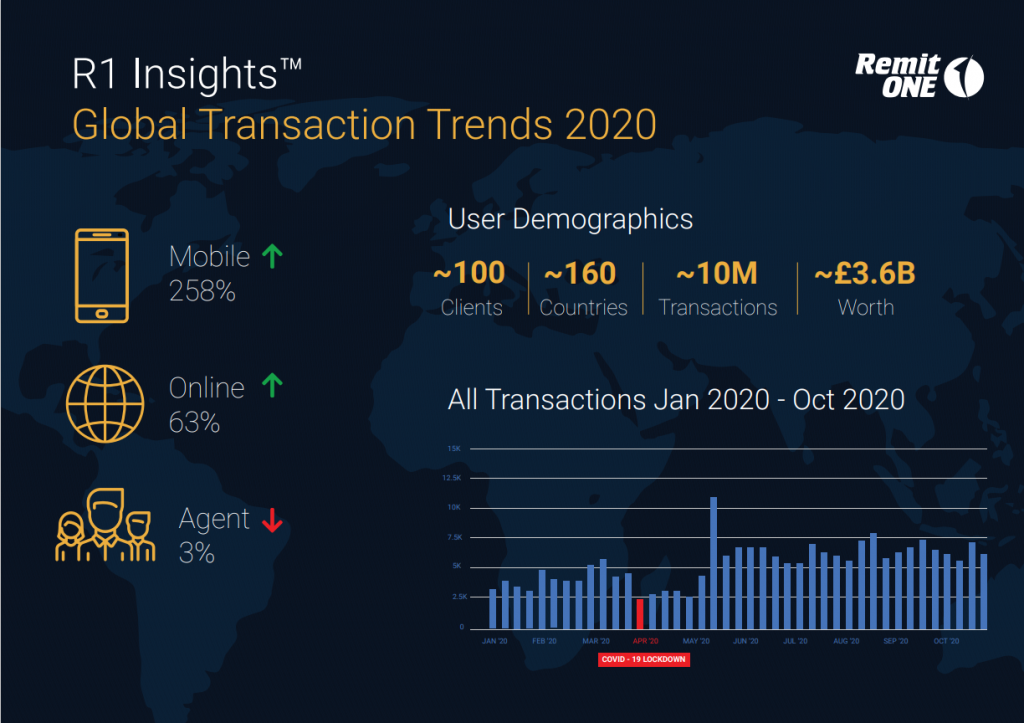

According to recent RemitONE transaction data trends, there has been a major acceleration of digital channel use during the pandemic. The use of physical agents, meanwhile, is down, which might seem insignificant but points to a drastic overall shift in consumer habit.

Throughout history, it’s the sectors that have been able to adapt to the times that have weathered the storms and retained their relevance. With the recession caused by COVID-19 taking a toll on the ability to send money home and remittance flows projected to decline even further by 14% in 2021, an easier, cheaper remittance solution has never been more vital.

Digital money transfer

Studies have proven that remittance not only helps to alleviate poverty in developing countries but can also lead to an increase in domestic spending. If there’s one thing we need right now it’s for people to be spending more. Digital-first MTOs are the ones ready to offer the most robust and accessible easy-to-use remittance services with fair and reliable exchange rates.

Of course, this is not a change that can happen overnight. Historically speaking, migrant communities would rely on physical money transfer services and these services have, as a result, become pillars of the community. Indeed, it’s estimated that the recipients of many international remittances are unbanked, which might go some way towards explaining why 90% of remittances currently begin and end with cash.

Does this mean it’s up to remittance operators to prove their worth and make themselves more accessible? Because digital operators that use the latest remittance software are not faster and only more affordable due to the obvious lack of overheads but have been proven to be better at evaluating customer experience and security.

Digital acceleration beyond the pandemic

It’s no exaggeration to suggest that COVID-19 changed the world overnight, but the impact on the migrant community has been under-reported. For months now, foreign travel has been almost impossible, which means migrant families have been unable to visit their families. What’s more, the pandemic has amplified the pressures migrants face in striking a balance between supporting themselves and supporting their families back home. For these families, digitally native money transfer operators will play a crucial role in redefining remittance and money transfer for a post-COVID world.

There are several benefits of digital transformation for the remittance sector for both legacy and upstart operators. Through the use of money transfer software on desktop computers and via smartphone apps, it’s never been easier and faster for customers to keep a reliable track of their remittance journey. The pandemic might have offered an opportunity for operators to use this software to foster trust and build new customer bases that keep communities connected and able to hold each other up.

This is proven by the growth of M-Pesa as the predominant payment method in Kenya. This is a digital solution that manifested because a traditional banking ecosystem was simply not accessible for a majority of Kenyans. That digital alternative quickly became the preferred option when users realised how powerful, easy, and convenient it was. Ultimately, it’s a safer, faster, and easier service that should help shoulder some of the stress that migrant families currently find themselves under.

Conclusion

Consumer preference has been shifting away from cash for years now and with many cash-based remittance solutions forced to close due to COVID-19, the future is definitely in digital. What money transfer operators and other fintech organisations need to understand is that this represents an incredible opportunity for them to prove their worth.

Borders might be closed but migrant workers still depend on remittance and if they’re going to make that switch from their old inflexible and outdated conventional means to more accessible solutions, they might need a bit of a gentle push.

To discuss your online offering with our team of experts please contact marketing@remitone.com

RemitONE can help you get your MSB License

One of the core strengths of RemitONE is helping companies in getting their MSB license. We can assist with obtaining a Money Service Business (MSB) license with your regulator.

If you are based in the UK, we can help you apply for all types of MSB licenses such as Small Payment Institution (SPI), Authorised Payment Institution (API), Small E-Money Institution (SEMI) and Authorised E-Money Institution (AEMI).

We have a proven track record, 98.2% of our clients get their MSB license!

If you are struggling to get your license, or would like to know how we can assist you in getting your license, contact us at info@remitone.com for more information.